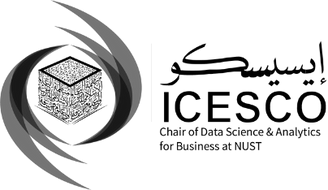

AI is significantly enhancing the efficiency of healthcare operations, particularly in areas like scheduling and billing. Here are the primary ways AI is being utilized:

Improving Patient Scheduling

Automated Scheduling Systems

AI-driven scheduling systems automate the appointment booking process, reducing manual intervention. These systems analyze historical appointment data and patient preferences to create optimal schedules, minimizing wait times and maximizing resource utilization.[4][6]

Predictive Analytics

Tools like Veradigm’s Predictive Scheduler use AI to forecast patient demand, allowing healthcare providers to prioritize appointments for high-need patients. This predictive capability helps in managing cancellations and no-shows, ensuring that schedules remain efficient and that patients receive timely care.[5]

Identifying Scheduling Friction

AI can uncover common obstacles in the scheduling process, such as frequent rescheduling or communication breakdowns. By analyzing patient interactions, AI identifies patterns that lead to inefficiencies, enabling healthcare providers to implement targeted improvements.[3][4]

Dynamic Resource Allocation

AI systems can dynamically adjust schedules in real-time based on unforeseen changes, such as staff availability or urgent patient needs. This flexibility ensures that healthcare resources are optimally utilized and that patient care is prioritized effectively.[4]

Enhancing Billing Processes

Revenue Cycle Management

AI streamlines revenue cycle management by automating billing tasks and improving accuracy in claims processing. This reduces the administrative burden on healthcare staff and minimizes errors that can lead to revenue loss.[1]

Fraud Detection and Prevention

AI algorithms can analyze billing patterns to detect anomalies that may indicate fraud. By identifying these issues early, healthcare organizations can mitigate financial risks and ensure compliance with regulations.[1][4]

Patient Communication and Follow-Up

AI tools enhance communication regarding billing by automating reminders and providing patients with clear information about their financial responsibilities. This proactive approach can lead to improved collection rates and patient satisfaction.

Conclusion

The integration of AI in healthcare scheduling and billing processes not only improves operational efficiency but also enhances patient experience. By automating routine tasks, predicting patient needs, and optimizing resource allocation, healthcare providers can focus more on delivering high-quality care while managing their operations effectively.