Project WeAscend

About The Project

Aawaz AI is committed to transforming Pakistan's financial landscape into one that is equitable and inclusive. Our mission focuses on bridging the gender and knowledge gap in business growth and access to financial products. We are dedicated to empowering female entrepreneurs and businesswomen in Pakistan by providing them with essential business skills and facilitating access to formal lending.

Pakistan currently has the lowest rate of female entrepreneurs globally. Only 8% of MSMEs are women-owned, and a mere 1% of women engage in entrepreneurial activities, compared to 21% of men. The growth of women-led businesses is often stymied by limited access to finance.

Aawaz AI addresses this challenge with innovative solutions. Our alternative data-based credit scoring models for financial institutions and our learning platform for women-owned small and medium enterprises (WSMEs) in Pakistan serve both the supply and demand sides of the credit market. Our products are already making a significant impact on enhancing financial inclusivity in the country. Financial services to women entrepreneurs are usually pink washed with limited consideration given to their intents and needs.

Project

WeAscend

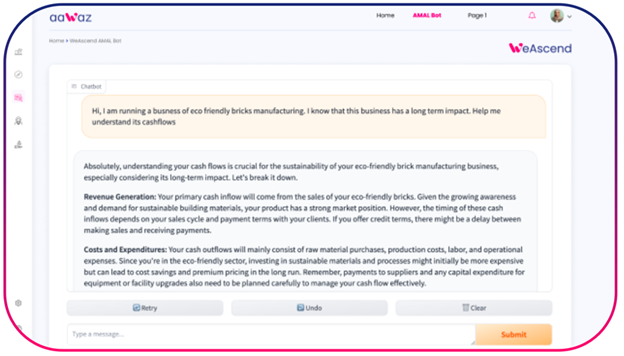

Students worked on one of our offerings, AMAL “Automated Mentor for Aspiring to Leaders”, a Chat-GPT style bot, for women-led small businesses and entrepreneurs to efficiently access business knowledge. Our multi-lingual bot generates personalized answers on business, finance, and entrepreneurship tailored to each user’s venture. AMAL also provides emotional support during challenging times and grows into a lifelong trusted business Co-pilot.

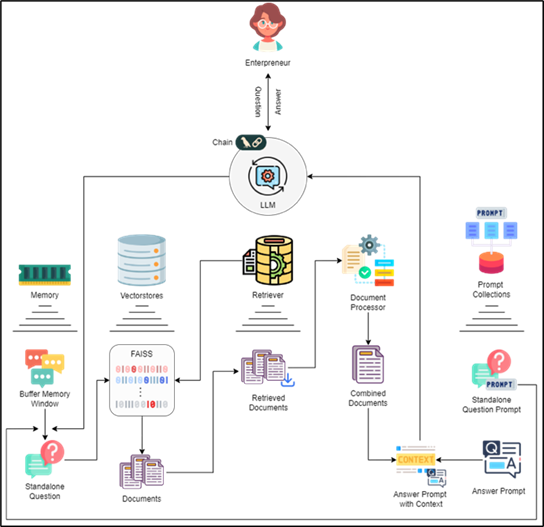

Workflow and High-Level Design

User submits a question to the AMAL bot.

Using prompt collection, the bot checks whether the question refers to the past chat history. If it does, it generates a standalone question to ensure clarity.

For questions needing more details, the retriever fetches relevant documents from vector stores.

Using collected prompts, the bot constructs response integrating retrieved information and current context

Project Impact

Increased Financial Inclusion

More women entrepreneurs will gain access to formal lending, enhancing their ability to grow and sustain their businesses.

Enhanced Business Skills

Female entrepreneurs will gain crucial business skills, improving their competency and confidence in managing and expanding their enterprises.

Bridging the Gender Gap

By empowering female entrepreneurs, we will contribute to narrowing the gender disparity in business ownership and entrepreneurial activities in Pakistan.

Alternative Credit Scoring Models

Financial institutions will benefit from more accurate and inclusive credit scoring models, enabling better risk assessment and increased lending to women-led businesses.

Reduction of Socioeconomic Barriers

By facilitating access to finance and business education, we will help dismantle the socioeconomic barriers that currently restrict women's entrepreneurial potential.

Sustainable Development

Supporting women entrepreneurs aligns with sustainable development goals, promoting gender equality and economic growth.

Publication / Marketing

Digital Presence and Online Visibility

Click below to see LinkedIn & Facebook posts.

Click HereNUST: Facebook

SEECS: Facebook

MachVIS: Facebook

MachVIS: LinkedIn

ICESCO Chair: Twitter

— ICESCO NUST (@icesco_nust) November 4, 2023